Posted on December 6, 2025 | By the Team Ford Las Vegas Business Pros

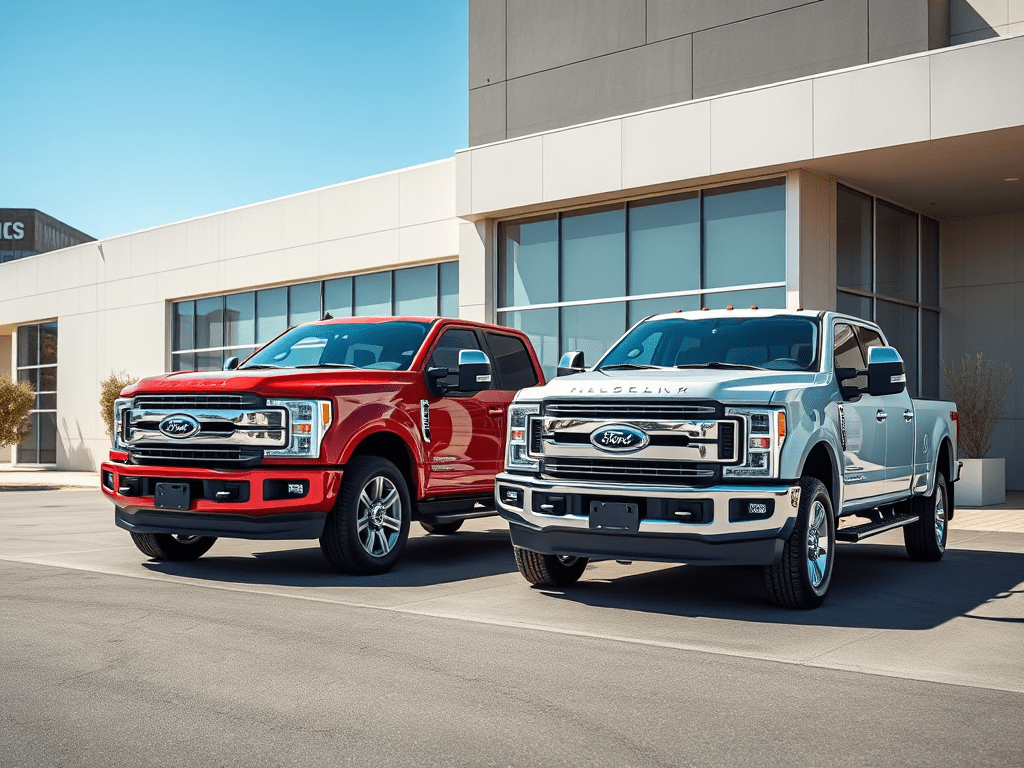

Picture this: Your company’s wrapping up the year with a solid profit, but those taxes are looming like a desert dust storm. What if snagging a new F-150 or Super Duty for your fleet could slash your bill by thousands—legitimately, no tricks? That’s the magic of end-of-year vehicle buys for businesses, thanks to tax perks like Section 179 deductions and bonus depreciation. In Nevada, where roads stretch from the Strip to remote job sites, timing your purchase before December 31 means claiming credits on your 2025 returns, turning a necessary upgrade into a smart financial move.

We’ve seen it firsthand at Team Ford Las Vegas—folks from Henderson contractors to Boulder City outfits rolling in during December to lock in these benefits. Tucked at 5445 Drexel Road (that convenient US-95 spot), we’ve helped hundreds maximize these rules, pairing ’em with Ford’s Q4 incentives like 0% APR on F-150 Lightnings and $2,750 cash on XLTs. If you’re Googling “end of year business vehicle tax credits Nevada” or “Section 179 deduction 2025 trucks,” here’s the no-fluff breakdown on why now’s the sweet spot—and how to make it work for your operation.

The Tax Perks That Make December a Business Buyer’s Dream

Uncle Sam’s got your back when it comes to equipping your business, especially at year-end. The big draws? Section 179 and bonus depreciation—tools designed to let you write off vehicle costs fast, reducing taxable income right when you file. Buy and “place in service” (start using for business) by December 31, and boom: Deductions hit your 2025 return, potentially saving thousands in taxes due April 2026.

- Section 179 Deduction: The Quick Write-Off King: This lets businesses deduct the full cost of qualifying vehicles in the purchase year, up to $2,500,000 for 2025 (phased out if total equipment spends top $4,000,000). For heavy-duty rides over 6,000 lbs—like F-150s or Super Dutys—the cap’s $31,300 per vehicle. Lighter ones? Still snag up to $20,200 first-year if bonus applies. Why end-of-year? Deduct now to offset current profits, not next year’s.

- Bonus Depreciation: Extra Juice for New Buys: At 100% for most qualifying property placed in service after January 19, 2025 (with options for 40% in early weeks), this piles on top of Section 179. Grab a ’25 Super Duty RC/SC for fleet work? Deduct the whole thing upfront if business use tops 50%. End-of-year timing locks it into 2025 taxes, avoiding future phase-downs (drops to 20% by 2026).

These aren’t gimmicks—they’re IRS-backed (check Form 4562 for details). For Nevada companies, no state income tax means federal savings shine brighter. But act fast: Purchases after December 31 shift to 2026 returns, delaying the relief.

Real-World Wins: How Nevada Businesses Cash In on Year-End Buys

We’ve crunched numbers for local outfits, and the math adds up. A Summerlin plumbing crew traded their old van for a 2025 Transit Cargo last December—deducted $40,000 via Section 179 + bonus, trimming their tax hit by $14,000 (at 35% bracket). Or that Henderson contractor who grabbed an F-150 Lightning: $4,000 Ford cash + full 100% bonus = $50K+ write-off, plus EV credits stacking $7,500 more.

Why better at year’s close?

- Maximize Current-Year Deductions: Offset 2025 profits before filing—cash back in your pocket sooner.

- Dealer Incentives Peak: Ford’s December grid amps rebates (e.g., $7,500 on Escape PHEVs, $4,000 on F-150 Lightnings)—pair with tax perks for double dips.

- Fleet Refresh Timing: Wrap up before inventory resets; avoid January price hikes.

- Avoid Phase-Out Risks: With Section 179 limits, squeeze in before your equipment total pushes phase-out.

Pro caveat: Business use must exceed 50% (track miles religiously), and recapture rules apply if it dips later. Consult your CPA—we’re not tax pros, but we’ve got partners who are.

| Tax Perk | 2025 Max Limit | Vehicle Fit | Nevada Business Example | Potential Savings (35% Bracket) |

|---|---|---|---|---|

| Section 179 | $2,500,000 overall; $31,300 for heavy SUVs/trucks | F-150, Super Duty over 6,000 lbs | Contractor buys $50K F-150—deducts full $31,300 | $10,955 tax cut |

| Bonus Depreciation | 100% (post-Jan 19) | New qualifying fleet vehicles | Electrician grabs $60K Transit—100% write-off | $21,000 savings |

| Combined Stack | Up to full cost | Hybrids/EVs like Escape PHEV | Delivery firm upgrades van—$7,500 cash + full deduct | $15,000+ total relief |

Estimates; actuals vary by bracket/use. Source: IRS Form 4562 draft.

Team Ford’s Playbook: Making Year-End Tax Plays Easy

At our Drexel spot, we don’t just hand over keys—we guide the tax angle. Swing by for a free appraisal (often $1K over KBB), then layer Ford’s deals: 0% on Mach-Es + $3,000 cash, or 0.9% on Explorers with $1,500 bonus. Our finance crew runs scenarios—deductible vans for your business? We’ll flag qualifying ones like Super Duty XL/XLTs with $1,500 cash.

A Boulder City landscaper nailed it last year: Traded a ’18 Ranger for a ’25 model, stacking $2,000 cash with full Section 179—shaved $12K off taxes. “Team Ford made it painless,” he shared. With our President’s Award-winning service (fourth time!), expect no-pressure vibes and same-day drives.

FAQs: Tackling End-of-Year Tax Credit Questions for Businesses

Q: Why buy a vehicle end-of-year for tax credits?

A: Deduct in 2025 to cut current taxes—wait till January, and it’s 2026 relief.

Q: What vehicles qualify for Section 179 in Nevada?

A: Most over 6,000 lbs like F-150s/Super Dutys—up to $31,300 deduct; lighter ones limited.

Q: Bonus depreciation still 100% in 2025?

A: Yes for post-Jan 19 buys—full write-off if business use >50%.

Q: Can I stack Ford rebates with tax credits?

A: Absolutely—$4,000 on Lightnings + 100% deduct = massive wins.

Q: Business use under 50%—what happens?

A: No full deduct; track miles or face recapture. Over 50%? You’re golden.

Q: How to start at Team Ford?

A: Call (702) 997-8440 for a tax-play consult—mention this post for free appraisal.

Wrap Up the Year Strong: Your Business Vehicle Awaits

End-of-year isn’t just countdowns and cheer—it’s your shot at tax-smart upgrades that fuel 2026 success. At Team Ford Las Vegas, we’re geared to make it happen with Nevada-tuned rides and deals that deliver. Don’t let credits slip—grab yours before the ball drops.

Ready to crunch numbers? Browse business-ready inventory or swing by. What’s your year-end plan—fleet refresh or EV switch? Share below!

Team Ford Las Vegas: Tax-Savvy Rides for Nevada Biz. Follow @TeamFordLV on X for more tips.

Leave a comment